For example, my personal GnuCash book has a plethora of expense accounts, just made up by me to categorize my spending, but all of the transactions are really just entries in my checking account.Īs to your actual question, I'd probably do this by tracking such savings as "negative expenses," using an expense account and entering negative numbers. Using Gnucash to track "budget envelopes" is kind of twisting it in a way it's not really designed for, though it may work well enough for what you're looking for.įirst of all, it's quite common-place in GnuCash (and in accounting in general, I believe) to have "accounts" that represent concepts or ideas rather than actual accounts at some institution. This can make it a little more annoying to reconcile your accounts (you need to use the "Include Subaccounts" checkbox), and I'm not sure how well it'd work if you ever imported transaction files from your bank.Īnother option may be to track your budgeting (which answers "How much am I allowed to spend on X right now?") separately from your accounting (which only answers "How much have I spent on X in the past?" and "How much do I own right now?"), using a different application or spreadsheet.

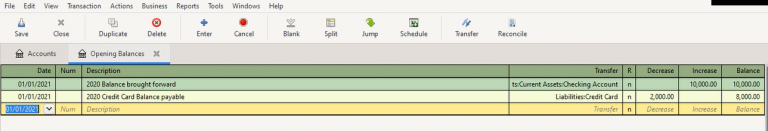

You could include that transfer as an additional split when you buy something, such as transferring $50 from Assets:Checking Account:Available Funds sending $45 to Expenses:Groceries and $5 to Assets:Checking Account:Long-term Savings. You may have deposits usually go into the "Available funds" subaccount, but when you want to save some money you transfer from that into a Savings subaccount. The total in the "Checking Account" parent represents your actual amount of money that you might reconcile with your bank, but you have it allocated in your accounting in various ways. You could use something like this as an Account Hierarchy: I think the closest concept to what you're trying to do is that you want to take your "real" Checking account, and segment it into portions. While it has some simple "budgeting" capabilities, they're primarily based around reporting how close your actual expenses were to a planned budget, not around forecasting eventual cash flow or "saving" a portion of assets for particular purposes.

An accounting general ledger is based on tracking your actual assets, liabilities, expenses, and income, and Gnucash is first and foremost a general ledger program.

0 kommentar(er)

0 kommentar(er)